Opportunity in Crisis

The recent Coronavirus has, perhaps, been the biggest disaster that the world and luxury have ever faced. Nothing of this magnitude ever was imagined or experienced even post the world wars, the famines, or the financial mayhems of 2008. However, with every such past crisis, history has been witness to human resilience, his ability to adjust and create a new normal. Life goes on – time and tide wait for none as they say.

With every crisis, there comes a new opportunity. Time and again, this has been proven true. Despite the telephone having been invented in the late 1800s, it became a new normal immediately and only after the First World War. Likewise, in 2003, post-SARS, Taobao emerged from Alibaba and became a new phenomenon. In India, the Demonetization of 2016, led to digital money & its leader PayTm, as the new normal. 9/11 changed travel security & 26/11 changed hotel security as a new and accepted normal forever. And the COVID-19 is already making work from home, digital banking, e-commerce, social distancing, etc. the new normal.

How about luxury?

In 2019, the luxury industry was estimated to be worth 281 billion Euros at a 4.1 percent CAGR. Many of the top luxury groups and brands enjoyed double-digit growth for several quarters. Ninety percent of the growth of the entire business was thanks to Chinese customers alone, reaching 35 percent of the value of luxury goods, according to a 2019 Bain study.

Luxury, since its very origins, meant slow pace, attention to detail, and custom-made. Rarity was the reason that justified the high value of the product. Luxury was the story of passionate creators aiming to leave a lasting mark in the history of excellence. More art than commerce was the true essence of luxury.

Soon after the corporatization of luxury, segmentation and targeting became the norm. Luxury positioned itself as an industry that sells items often bought for status or self-pleasure or differentiation or even the feel-good factor. However, in a time comparable to a war-like scenario, it won’t be a priority for many of those customers that were used to stock wardrobes of pricey items, losing their appeal after just one season.

Besides, as per a study by HBR, during a recession or crisis like it is now, the normal market segmentation does not hold true. It changes into four different categories:

- Those who slam on the brakes and conserve every penny they may have.

- Those who are pained but patient to be cautious with their expenditure and wait for good times to return.

- The comfortably well-off affluent customer, for whom recession or economic downturns do not matter.

- And finally, the YOLO or live for the day generation.

Luxury essentially targets the last two of the above.

So will luxury have a setback?

Yes, surely, but it will bounce back quickly simply because, for someone for whom luxury is a way of life, his benchmarks will not change. A hedonist enjoys what he buys. His taste levels do not accept anything lower than what he perceives as acceptable. He was always buying for his own satisfaction and will continue to do so. On the other hand, the aspirant for whom luxury is a treat, a social declaration of his success, his feel-good trophy, will continue to live for the moment. Of course, the quantity will be replaced by quality.

So what will post COVID-19 luxury look like?

After the COVID-19 crisis dissipates, we will see brands and companies fall into one of two categories.

There will be those that don’t do anything, hoping such a disruption won’t ever happen again. These companies will be taking a highly risky gamble.

And there will be firms that heed the lessons of this crisis and make investments in mapping their supply networks so they do not have to operate blindly when the next crisis strikes. They will rewrite their contracts, operating procedures, and processes so they can quickly figure out solutions when disruptions occur. These companies will be the winners in the long term.

Luxury sales are expected to suffer a year-over-year decline of 25 percent to 30 percent, according to the latest research from Bain & Company.

Aspects that are expected to continue into 2021 and beyond include:

- A decrease in consumer confidence

- A decrease in willingness to spend

- Travel will shift from no travel to cautionary & necessary travel.

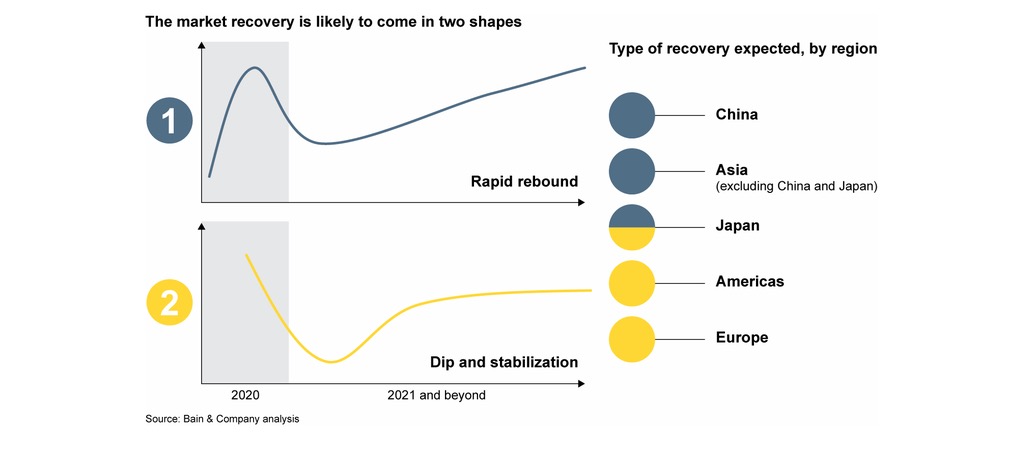

The evolution and duration of the pandemic will surely be impacted by the response of individual governments and populations, however, Bain & Company predicts that the market is likely to recover in two different schematics for 2021 and forward.

Strategies for the new normal – consumer trends:

- An accelerated shift to digital shopping: This is likely to super-accelerate both, because consumers have more time on their hands, but also because interacting with e-commerce sites has become a necessity. Omnichannel is the necessitated future.

- Changes in store operating procedures: Restricted number of clients permitted into the mall and stores; heightened sanitation procedures; staggered and longer operating hours will all be a result of the new social distancing normal. Operating costs will rise, while inefficient stores will face closure. Brands with multiple stores will keep the best-performing ones on, while the rest will shutter.

- Shows without live audiences: With travel restrictions and limitations on crowd assembly, the digital launch of collections is a new normal. Besides, the cost of travel will shoot up due to the reduced number of passengers allowed on board.

- Heightened environmental and social consciousness: For pioneering brands, investments in sustainability and innovation are of high strategic importance. Quality over quantity will be the new mantra. Sustainability beyond lip service will be warranted.

- Sharing economy may suffer: Health-related concerns growing out of the pandemic will impact the growth of rental and re-usable luxury. Hygiene and sanitation SOP’s will become the deciding criteria for consumer choice.

- Rise of a post-aspirational mindset: Ethics will become as important as aesthetics as consumers prioritize purposeful brands. Anticipate shift in consumer mind-set

- Strengthened local pride: Brands need to avoid being insensitive to local cultures and pride. The de-globalization phenomenon is backed by a rising urge for patriotism.

- Expanding the need for inclusion: Brands need to include reduced spending powers by ensuring response to the mall ticket players. The lipstick effect is most prominent amongst the aspirational class. This time, lipstick is likely to be replaced by eyeliners and mascara, given the need to wear a mask in public.

- Stay relevant to customers: Re-assure the existing customers through editorial and personal engagement wrt social distancing, hygiene, and other such measures they may be taking.

- Develop a 360-degree customer strategy: Be more customer-centric, agile, and sustainable. Adopt the HEART framework of sustained communications.

Humanize your company

Educate about change

Assure stability

Revolutionize offerings

Tackle the future